- Recently, when news broke about North Korean troops participating in the Russia-Ukraine war, many would have already seen the photos released by the National Intelligence Service in various news articles.

- At the time when North Korea was vehemently denying its troop deployment, photos were released capturing the movement of special forces at Chongjin Port in North Korea.

- These photos were reportedly taken by South Korea’s reconnaissance satellite. Additionally, two more photos were taken via Airbus, a private satellite company, but they were never publicly disclosed.

- Even with only South Korea’s reconnaissance satellites, North Korea’s troop movements are being tracked, so it is hard to imagine how much data is being provided by the enormous military and private reconnaissance satellites of the United States.

- In the Ukraine war, satellites are recognized as having an absolute influence.

- When Russia invaded Ukraine in November 2022, it was expected to force a surrender in less than a year.

- However, as of November 2024, Ukraine has endured for two years and is now entering its third year.

- There are various reasons why Ukraine has managed to endure despite Western countries not directly intervening, but the most frequently mentioned factor is the provision of satellite data.

- When coordinates of Russian troop locations or predicted positions are provided, all that needs to be done is launch missiles at those coordinates.

- This satellite business is rapidly growing in the United States under private sector leadership.

- Previously, most space development was led by the government (NASA), but now it has transitioned to private companies, attracting massive private capital into the market.

- The launch vehicle market has shifted from NASA to SpaceX.

- Satellite manufacturing has transitioned from NASA to companies like Maxar, Airbus, and Planet Labs, with their market capitalization increasing 2–3 times over 2–3 years, drawing in significant capital.

- Although still at an early stage, South Korea has also begun policy changes to nurture private companies under government initiatives.

- In May 2023, the official Space Agency was launched, with the head of the agency given vice-ministerial status.

- For 2024, KRW 992.3 billion was allocated for space development, and under the 4th Space Development Promotion Plan, KRW 1.5 trillion in investment is planned by 2027.

- The government intends to promote business by directly purchasing public satellite launch services.

- As the industry currently faces high costs exceeding profits, it is expected that only a few companies with unique technologies ensuring profitability, like SpaceX, will survive by reducing costs through vertical integration.

- As of now, the top-tier companies by revenue in the value chain are:

- Hanwha Systems (한화시스템, KOSPI: 272210) for launch vehicles, Intellian Technologies (인텔리안테크, KOSDAQ: 189300) for ground services, and Satrec Initiative (쎄트렉아이, KOSDAQ: 099320) for satellite manufacturing.

- Despite being top-tier, these companies are still primarily generating revenue through government-led projects.

- However, just as in the U.S., South Korea’s private companies are expected to enter a growth trajectory supported by private capital and technology after sufficient maturation.

- Among these companies, Satrec Initiative has acquired technology comparable to U.S. private satellite companies but has yet to reach economies of scale.

- First, we begin by identifying what kind of company it is.

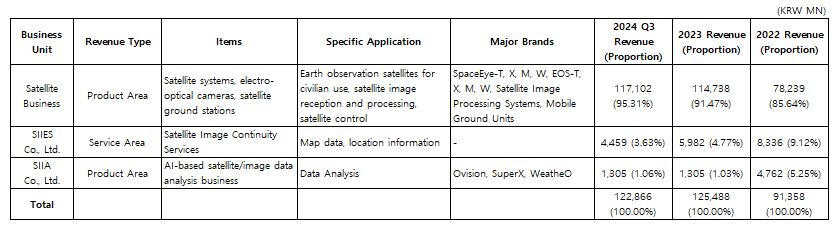

- Satrec Initiative generates most of its revenue from manufacturing earth observation and military satellites.

- Satrec Initiative specializes in manufacturing earth observation and military satellites. Its flagship products include the EOS and SpaceEye series.

- EOS is primarily used for environmental observation and is focused on smaller satellites, while SpaceEye is designed for high-resolution earth observation, featuring larger and heavier satellites that provide clearer images.

- The EOS series is mainly used for agriculture, forestry, and environmental observation, capable of collecting detailed environmental data using 11 color bands.

- The EOS SAT-1 is a small satellite weighing 178 kg that provides images with a resolution of 1.4m–2.8m.

- The SpaceEye series is primarily focused on high-resolution earth observation.

- It is divided into subcategories (T, X, M, W) based on purpose, size, weight, and resolution.

- The SpaceEye-T is a medium satellite weighing 650–700 kg that provides ultra-clear images with a resolution of 0.3m–1.2m.

- The SpaceEye-X is known as a model offering super-high resolution of 0.5m.

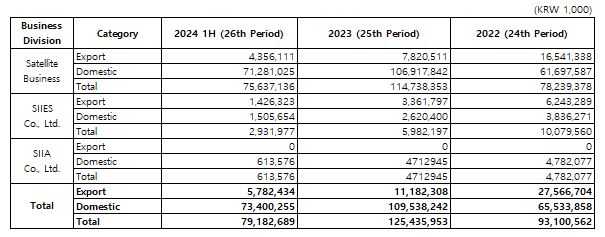

- Most of its revenue is generated domestically.

- Although some export sales occurred in 2022 and 2023, they did not lead to growth and instead declined.

- However, domestic revenue itself is rapidly increasing, with first-half 2024 revenue nearly matching full-year 2022 revenue.

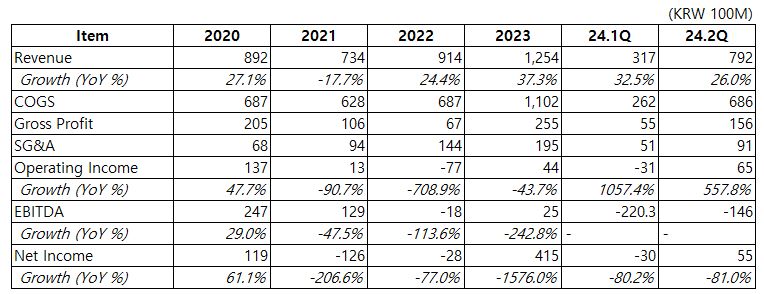

- However, profit margins have been inconsistent, and the company has not yet achieved steady profitability.

- It is still too early to evaluate the company’s stock price based on current performance.

- Let us now focus on how the company might change going forward.

- The satellite manufacturing market was worth USD 17.3 billion (KRW 24 trillion) in 2023 and is expected to grow annually by 6.2%, reaching USD 27.8 billion (KRW 39 trillion) by 2030.

- Major global players in this market include Maxar (U.S.), Airbus (Europe), and IAI (Israel).

- Maxar and Airbus are known to hold about 20% of the market, and beyond these three companies, numerous small and medium-sized companies and startups are entering the satellite manufacturing sector, intensifying competition.

- Focusing solely on Maxar for comparison, its revenue is USD 1.61 billion, with a market cap of USD 4.00 billion.

- Converted to Korean won, that is KRW 2.2 trillion in revenue and a KRW 5.6 trillion market cap.

- Satrec Initiative has revenue of KRW 140 billion and a market cap of KRW 500 billion.

- Maxar’s revenue is 15 times higher, and its market cap is 11 times larger.

- In simple valuation terms, it is hard to say that Satrec Initiative is undervalued compared to its global peers.

- Considering the possibility of rapid revenue growth akin to Maxar, such a scenario appears highly unlikely.

- Currently, Satrec Initiative’s revenue primarily comes from government contracts. Since government procurement depends on budget constraints, it is limited and highly predictable.

- For revenue to grow to Maxar’s level, domestic and international private demand would need to surge suddenly.

- However, the company has never secured such orders before, and even if it did, its production capacity does not allow for unlimited revenue growth.

- Regrettably, Satrec Initiative will remain on the watchlist as we move on to the next company in the space and aerospace value chain.

[작성자:] henrybus

-

[SPACE / KOSDAQ: 099320] Can Satrec Initiative, a Top-Tier Satellite Manufacturer in Korea, Expand Globally?

-

TEST

TEST

-

안녕하세요!

워드프레스에 오신 것을 환영합니다. 이것은 첫 글입니다. 바로 편집하거나 삭제한 다음 쓰기 시작하세요!